Shuttered restaurants and supply chain challenges have driven operators increasingly to the second-hand market.

Mark Hamstra | Sep 15, 2021

The pandemic has been a perfect storm to drive restaurant operators to the used equipment market. Thousands of foodservice locations closed their doors and were forced to liquidate, while equipment makers are struggling with ongoing supply chain delays.

And that’s led to opportunity for growth-minded operators who are seeking cost-savings opportunities in an uncertain economy.

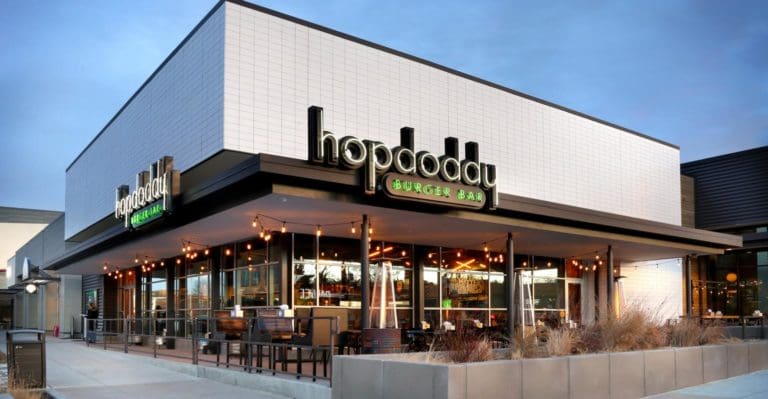

Fast-casual chain Hopdoddy Burger Bar, for example, has leveraged the used equipment market during the past year-plus.

“It’s been key for us as we look to repurpose our used equipment and as we look to acquire equipment,” said Jeff Chandler, CEO of the Austin, Texas-based company.

He cited months-long delays in the equipment-manufacturer supply chain for some items as one of the key reasons Hopdoddy has explored the market for second-generation equipment. Fryers and refrigeration components, such as compressors, have been among the equipment pieces that have been challenging to find, he said, but they have been readily available in the second-hand market.

Hopdoddy first turned to the pre-owned restaurant equipment market as a seller, when the company decided to close some locations permanently early in the pandemic. The burger-and-beer chain worked with TAGeX Brands, a specialist in the repurposing of restaurant equipment, to sell some of the equipment from its shuttered locations and to store some of its fixtures and furnishings that it wanted to save for potential future use.

Since then, Hopdoddy has returned to growth mode and has been able to meet its demands for equipment to open new stores by purchasing certain items through TAGeX as well, which has helped the chain bypass backlogs in the supply chain for new equipment. Buying used equipment has also provided some cost savings as the company begins fitting out its newly acquired locations, Chandler said.

“We know that used equipment is pennies on the dollar, so it saves us considerably,” he said. “Plus, we have developed a level of trust so that we know the equipment is going to be in good working order, and not a piece of junk.”

In some second-generation locations, Hopdoddy also has been able to take advantage of existing equipment retained by landlords after a space has been vacated by a previous operator. Walk-in refrigeration units and rangehoods are often part of the shell that is left in place, and sometimes these can be retained, provided Hopdoddy’s cook line fits under the existing rangehood, Chandler said.

Hopdoddy has six restaurants in development and expects to ramp back up to a pace of eight to 12 new locations per year, he said. The chain simplified some of its operations during the pandemic and has retooled itself for growth with a refreshed concept, Chandler said.

Neal Sherman, founder and president of TAGeX Brands, said his business, which includes auction sites and direct sales, ramped up significantly during the pandemic as the company began seeing a surge in interest from multi-unit chains.

“The demand exploded because people were being much more judicious with their budgets/cap-ex dollars, and the supply chain was and is still challenged,” he said.

Although restaurant chains tend to adhere to strict equipment specifications overall, the pressures of the pandemic may be forcing many to become a little less rigid, said Sherman.

“Necessity is the mother of invention,” he said. “I think multi-unit operators are much more open-minded than they were before the pandemic.”

Sherman said used equipment can often sell at discounts of 40-80% below the price of new items.

Amid today’s supply chain challenges, many operators may also be looking at ensuring they have some back-up equipment available, he explained.

“It used to be that when supply was plentiful, you could always get your hands on a fryer,” Sherman said. “You didn’t have to build a backstock of mission-critical pieces in the event that one fails or you have greater need.”

In addition to the increased interest among equipment buyers, TAGeX also saw a massive volume of previously owned equipment coming onto the market for sale as operators either closed locations or retooled their operations. Restaurants reconfigured their facilities to focus on takeout and drive-thru, for example, and supermarkets nationwide removed their salad bars.

Some foodservice companies approach the selling and buying of used equipment as an environmentally friendly option, saving some pieces from potentially ending up in landfills, Sherman said. In fact, he said there is an opportunity for more operators to promote their use of repurposed equipment as part of their communications strategy around sustainability, right alongside their claims about biodegradable utensils, paper straws and compostable packaging.

“They should be talking about the fact they are making good, sustainable decisions,” Sherman said. “The materials that make up back-of-the-house equipment, whether it’s stainless steel or copper, don’t biodegrade the way that packaging will.”

Credit: Used equipment market booms as operators leverage new opportunities (nrn.com)